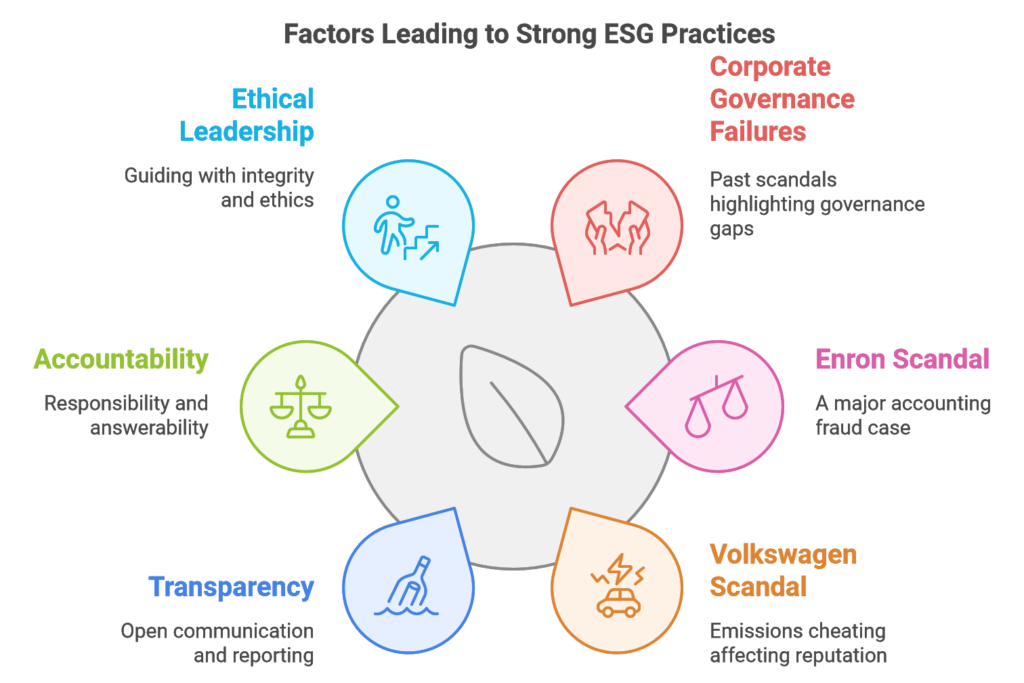

Corporate governance—the system of rules, practices, and processes by which a company is directed and controlled—plays a vital role in ensuring long-term sustainability and ethical conduct. In recent years, the failures of major corporations have underscored the need for robust governance structures and adherence to Environmental, Social, and Governance (ESG) principles. From the Enron scandal to more recent cases like Volkswagen’s emissions scandal, corporate governance failures reveal critical gaps that threaten not only companies but also stakeholders and the wider economy.

This blog post explores major corporate governance failures, their lessons for strengthening ESG practices, and why prioritizing transparency, accountability, and ethical leadership is key to building resilient businesses.

Understanding Corporate Governance Failures

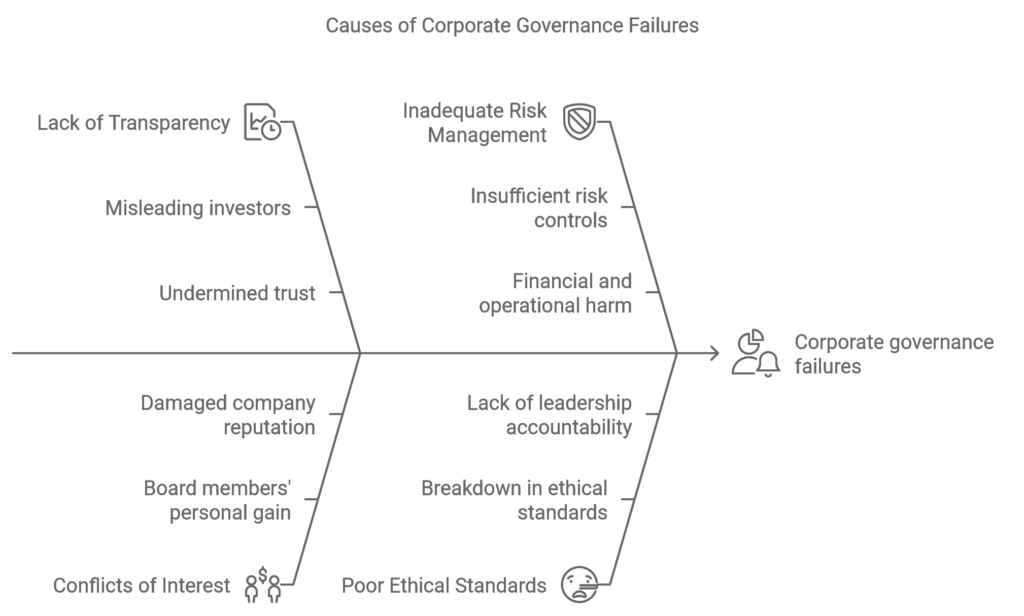

Corporate governance failures occur when companies lack strong policies, oversight, and ethical leadership, often resulting in unethical or illegal practices. These failures commonly involve:

- Lack of Transparency

When companies fail to disclose critical information to shareholders, they risk misleading investors and undermining trust. Transparency is essential for stakeholders to make informed decisions and for companies to maintain credibility. - Conflicts of Interest

Board members and executives should act in the best interest of the company and its shareholders. However, conflicts of interest—such as prioritizing personal gain over company welfare—can lead to unethical practices and damage company reputation. - Inadequate Risk Management

Effective risk management helps companies anticipate and respond to potential threats. Governance failures often stem from insufficient risk controls, resulting in financial, operational, or reputational harm. - Poor Ethical Standards

Without a strong ethical foundation, companies risk fostering a culture where misconduct goes unchecked. Governance failures often reflect a breakdown in ethical standards and leadership accountability. - Weak Oversight and Accountability

Effective governance requires vigilant oversight by the board of directors and transparent, accountable leadership. Weak oversight allows mismanagement to persist, often leading to unethical practices and regulatory breaches.

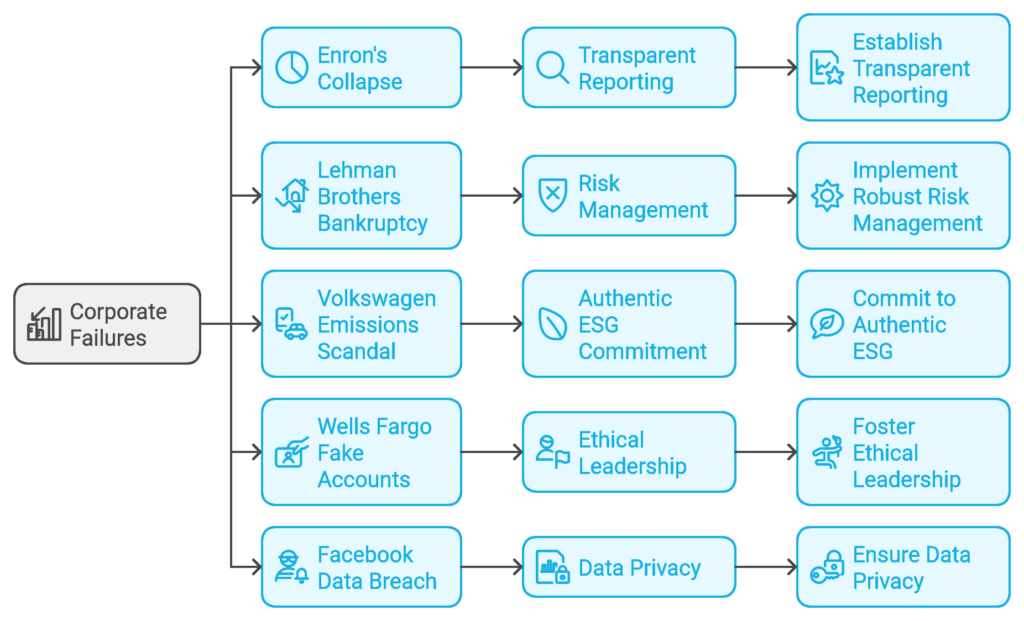

Notable Corporate Governance Failures and Key Lessons

Examining past corporate governance failures offers valuable insights into what companies can learn and how they can avoid similar pitfalls. Here are a few high-profile cases and their lessons for integrating effective ESG practices:

1. Enron (2001)

Failure: Enron, once one of America’s most innovative energy companies, collapsed after its top executives engaged in extensive accounting fraud, hiding debt and inflating profits to mislead investors. Enron’s fall resulted in losses of billions for shareholders and prompted new regulations to improve transparency and accountability.

Lesson: Enron’s collapse highlights the need for accurate and transparent reporting. Companies must uphold honesty in financial disclosures, and boards should ensure thorough oversight and independent audits to avoid manipulation of financial data.

2. Lehman Brothers (2008)

Failure: Lehman Brothers, a global financial services firm, filed for bankruptcy due to excessive risk-taking and inadequate oversight. Their extensive use of leverage and complex financial products led to a collapse that triggered a global financial crisis.

Lesson: This case underscores the importance of effective risk management and clear ethical boundaries in financial decisions. Companies must create clear guidelines for acceptable risk levels and develop frameworks for sustainable, long-term growth rather than short-term gains.

3. Volkswagen (2015)

Failure: Volkswagen’s “Dieselgate” scandal erupted when it was revealed that the automaker had installed software in vehicles to cheat emissions tests. The scandal cost the company billions and damaged its reputation, undermining its commitment to environmental sustainability.

Lesson: Volkswagen’s case serves as a reminder of the importance of authentic ESG commitment. ESG practices should be genuinely embedded into company values and operations, not used as a mere marketing strategy. Consistent, transparent adherence to environmental standards is essential to maintaining trust.

4. Wells Fargo (2016)

Failure: Wells Fargo’s governance failure was exposed when it was revealed that employees had created millions of fake accounts to meet aggressive sales targets. This scandal highlighted flaws in the company’s internal controls, culture, and executive oversight.

Lesson: Wells Fargo’s failure emphasizes the need for strong corporate culture and ethical leadership. Companies should ensure that performance metrics don’t encourage unethical behavior and foster a workplace where employees feel empowered to speak up about misconduct.

5. Facebook (Cambridge Analytica, 2018)

Failure: The Cambridge Analytica scandal involved Facebook’s failure to protect user data, allowing a political consultancy to access and misuse personal information for targeted political campaigns. This breach of privacy sparked public backlash and regulatory scrutiny.

Lesson: Facebook’s case illustrates the importance of data privacy and protection as part of governance. Companies handling sensitive data should prioritize cybersecurity and transparency to safeguard users’ rights and maintain public trust.

Lessons for Strengthening ESG through Effective Governance

Corporate governance failures provide insights into how companies can better integrate ESG principles to build a sustainable future. Below are key lessons for strengthening governance structures within an ESG framework:

1. Establish Transparent Reporting and Communication

Transparent reporting is the foundation of good governance. Companies should disclose financial data, ESG metrics, and risk assessments clearly and honestly to build trust. Stakeholders expect to know how companies are addressing ESG issues, including environmental impact, social responsibility, and governance practices.

2. Foster a Culture of Ethical Leadership

Ethical leadership drives a company’s culture and influences all aspects of business conduct. Boards and executive teams must set the standard by promoting integrity, honesty, and accountability at every level. A strong ethical culture empowers employees to act responsibly and reinforces the company’s commitment to ESG principles.

3. Prioritize Stakeholder Engagement

Effective governance includes recognizing the interests of all stakeholders, not just shareholders. Engaging with customers, employees, suppliers, and local communities allows companies to understand their needs, identify potential risks, and address concerns related to ESG issues, from labor rights to environmental impact.

4. Implement Robust Risk Management Practices

Risk management is essential for identifying and mitigating potential threats to the business. Companies should integrate ESG factors into their risk management framework, addressing issues such as climate risks, data security, and social impact. Comprehensive risk management can prevent crises and strengthen a company’s resilience.

5. Ensure Board Independence and Accountability

An independent and accountable board is crucial for effective governance. Boards should be composed of members who are not influenced by management, enabling them to provide unbiased oversight. Regular board evaluations, ethical training, and clear accountability mechanisms can enhance governance effectiveness.

6. Commit to Data Privacy and Cybersecurity

With the rise of digitalization, companies must prioritize data privacy and cybersecurity as part of their governance structure. Protecting user data is not only a regulatory requirement but also a social responsibility that builds customer trust. Companies should implement stringent security measures and communicate data policies transparently.

The Growing Importance of ESG in Corporate Governance

As stakeholders demand greater accountability, ESG is evolving from a trend to a necessity in corporate governance. Here’s how ESG is influencing the future of governance:

- Regulatory Pressures: Governments worldwide are implementing policies and frameworks to improve corporate governance, focusing on transparency, environmental responsibility, and social equity. Companies that fail to adhere to these guidelines may face penalties, loss of investor confidence, and reputational damage.

- Investor Expectations: Investors are increasingly prioritizing companies with strong ESG commitments. Governance failures often result in significant financial losses and harm investor confidence. Companies that demonstrate strong governance practices attract responsible investment and enjoy better long-term stability.

- Consumer and Employee Demand: Consumers and employees seek companies that prioritize ethical standards, sustainability, and inclusivity. By aligning governance with ESG values, companies can build stronger relationships with customers, attract top talent, and foster a more engaged workforce.

Conclusion: The Path Forward for ESG-Aligned Corporate Governance

Corporate governance failures underscore the need for companies to implement transparent, accountable, and ethical governance structures that align with ESG principles. Effective governance goes beyond compliance; it’s about creating a sustainable and resilient organization that prioritizes the well-being of all stakeholders.

For companies aiming to strengthen their governance framework, the lessons from past failures offer valuable insights. Establishing transparent reporting, fostering a culture of ethical leadership, engaging with stakeholders, implementing risk management, ensuring board independence, and prioritizing data privacy are critical steps toward sustainable success.

As the business landscape evolves, companies that integrate ESG into their governance framework will be better positioned to adapt, thrive, and make a positive impact on society. By learning from past mistakes and committing to responsible governance, businesses can lead the way toward a future where profits align with purpose, sustainability, and social good.