As the effects of climate change become more pronounced, investors are increasingly focused on how it impacts their portfolios. From shifting weather patterns to regulatory pressures, climate change presents risks that can affect the value and stability of investments. At the same time, the push toward a low-carbon economy brings opportunities for investors to capitalize on new markets and industries that are critical to addressing environmental challenges.

In this blog, we’ll explore the main risks climate change poses for investors, the opportunities emerging from the green transition, and strategies for incorporating climate considerations into investment portfolios.

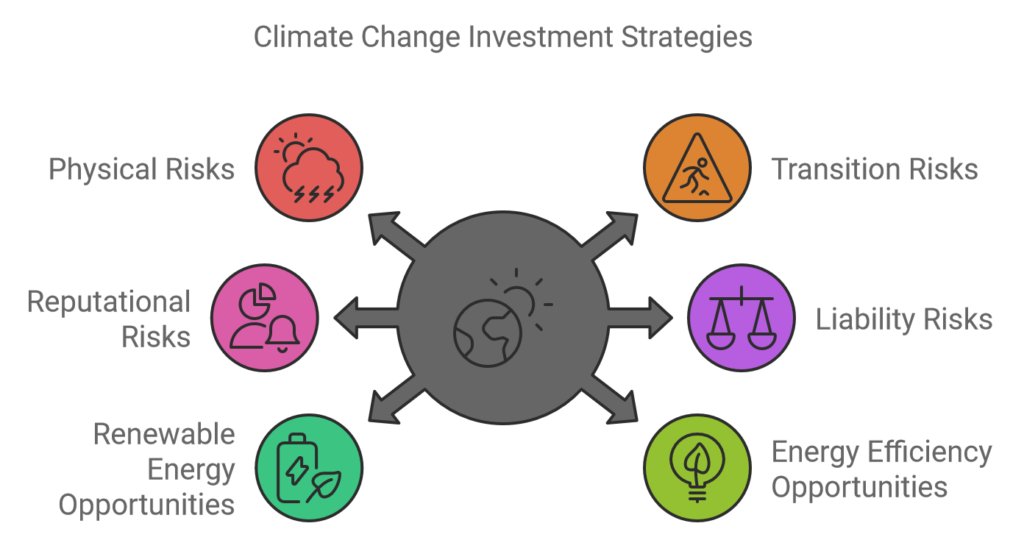

Understanding Climate Change Risks for Investors

Climate change can impact investments in direct and indirect ways. Here are some key risks:

1. Physical Risks: Natural Disasters and Extreme Weather

The increased frequency of extreme weather events like hurricanes, floods, droughts, and wildfires can directly damage assets, disrupt supply chains, and increase operational costs for companies. Real estate, agriculture, energy, and infrastructure are among the sectors most affected by physical climate risks.

- Example: Coastal real estate and infrastructure are particularly vulnerable to rising sea levels, which can decrease property values and increase insurance costs. Investors with portfolios heavy in real estate need to assess these risks carefully.

2. Transition Risks: Shifts in Policy and Regulation

As governments enact policies to combat climate change, companies face regulatory changes that can affect their profitability. For example, carbon taxes, emission reduction targets, and stricter environmental standards can increase costs for companies in high-emission sectors like fossil fuels, manufacturing, and transportation.

- Example: The European Union’s Carbon Border Adjustment Mechanism (CBAM) is set to impose tariffs on imports based on their carbon footprint, impacting industries dependent on high-carbon imports.

3. Reputational Risks: Shifting Public Opinion and Consumer Behavior

Consumers and investors are becoming more climate-conscious, leading to a shift in demand toward environmentally responsible brands. Companies that fail to adopt sustainable practices may face reputational risks, resulting in reduced sales, investor divestment, and difficulties attracting talent.

- Example: Fast fashion brands that ignore environmental impact are increasingly criticized for wasteful practices, which can lead to a loss of brand loyalty among eco-conscious consumers.

4. Liability Risks: Legal Action and Accountability

Companies may face legal risks if they fail to comply with environmental regulations or if they are linked to significant environmental degradation. Liability risks could lead to lawsuits, fines, or requirements for costly environmental restoration.

- Example: Several oil and gas companies have faced lawsuits from states and cities seeking compensation for the costs of climate adaptation and mitigation.

Opportunities Created by the Transition to a Low-Carbon Economy

The transition to a more sustainable economy offers investment opportunities in several fast-growing industries. Here are some sectors that are poised to benefit:

1. Renewable Energy and Clean Technology

Investments in renewable energy sources like solar, wind, and hydropower have been accelerating as countries seek to reduce their dependence on fossil fuels. Clean technology, which includes energy storage, electric vehicles, and smart grids, is also attracting substantial investment as governments incentivize green technologies.

- Example: Solar energy capacity has been expanding globally, supported by falling costs and government incentives, making it an attractive sector for long-term investment.

2. Energy Efficiency and Green Buildings

Companies that focus on energy efficiency solutions, such as green building materials and energy-efficient appliances, are seeing increased demand as businesses and individuals strive to reduce energy consumption and costs.

- Example: The global green building materials market is expected to grow significantly, driven by eco-friendly construction practices and incentives for energy-efficient real estate.

3. Carbon Markets and Offsetting Programs

As more countries implement carbon pricing and emission trading schemes, carbon credits have emerged as a new asset class. Investing in carbon markets allows investors to gain exposure to assets that will likely appreciate as emission reduction targets become stricter.

- Example: The EU Emissions Trading System (ETS) has become one of the largest carbon markets in the world, with prices rising as emission targets tighten.

4. Climate-Resilient Agriculture and Food Security

Climate change is disrupting traditional agricultural practices, creating demand for climate-resilient crops, sustainable farming methods, and food security technologies. Companies focusing on sustainable agriculture and innovative food solutions, like plant-based proteins and vertical farming, are well-positioned to thrive.

- Example: Vertical farming companies, which use less water and land than traditional agriculture, are attracting investment as a sustainable alternative to conventional farming.

5. Water Infrastructure and Management

Water scarcity is a growing concern in many regions, making water infrastructure a crucial investment area. Companies that develop technologies for water conservation, purification, and efficient management are increasingly in demand.

- Example: Desalination technologies and water recycling solutions are gaining traction in arid regions, creating investment opportunities in companies providing these services.

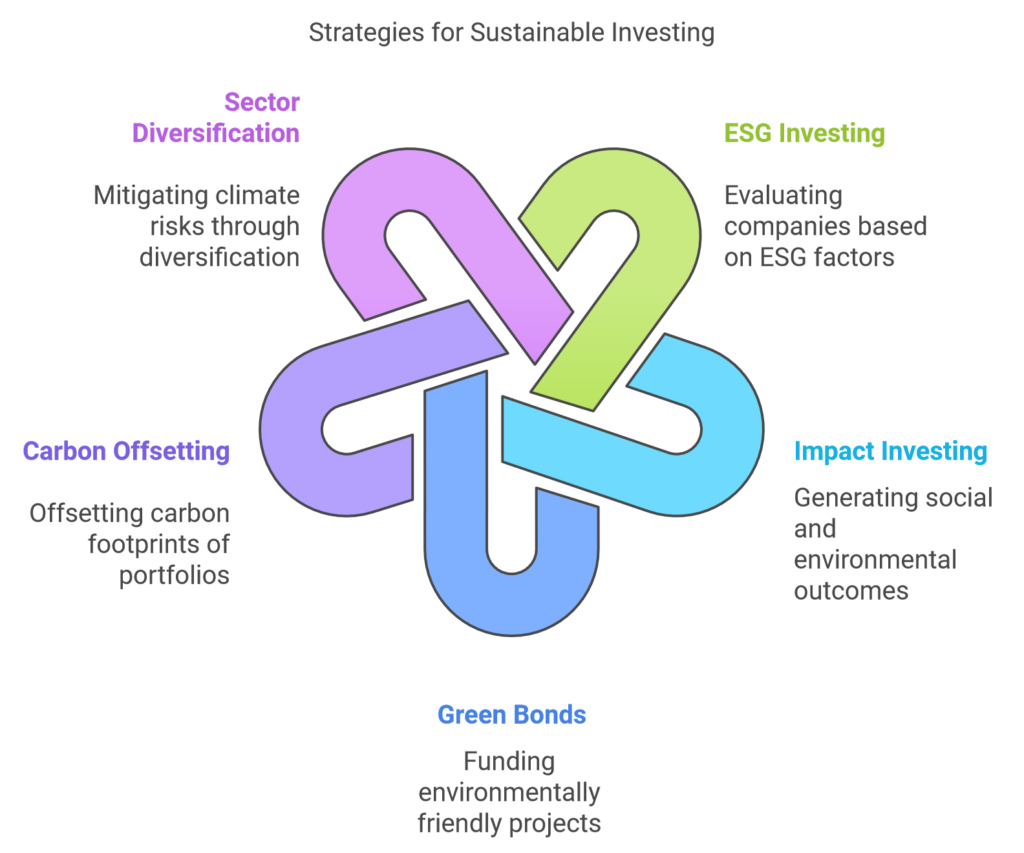

Strategies for Integrating Climate Considerations into Investment Portfolios

Investors looking to align their portfolios with climate goals have several strategies available. Here are a few key approaches:

1. ESG (Environmental, Social, and Governance) Investing

ESG investing involves evaluating companies based on environmental, social, and governance factors in addition to financial performance. By screening for companies with high ESG scores, investors can reduce their exposure to climate-related risks and support companies with sustainable practices.

- Example: Many ESG funds specifically exclude companies in high-emission sectors, such as coal or oil, and focus on industries with lower environmental impact.

2. Impact Investing

Impact investing aims to generate positive social and environmental outcomes alongside financial returns. This strategy often focuses on companies addressing climate change directly, such as renewable energy providers or companies involved in conservation efforts.

3. Green Bonds and Climate Bonds

Green bonds are a type of fixed-income investment specifically issued to fund environmentally friendly projects, such as renewable energy or pollution reduction initiatives. Climate bonds, which target climate adaptation and resilience projects, offer investors the chance to support climate-focused initiatives while receiving stable returns.

4. Carbon Offsetting and Sustainable Indices

For investors looking to offset the carbon footprint of their portfolios, carbon offset programs can be a viable solution. Additionally, sustainable indices, such as the S&P Global Clean Energy Index, allow investors to track and invest in a basket of companies in the renewable energy sector.

5. Sector Diversification and Climate Hedging

Diversifying across sectors and investing in companies positioned to thrive in a low-carbon economy can help mitigate climate risks. Some investors also hedge against climate-related risks by investing in sustainable agriculture, water management, and renewable energy.

Conclusion

The shift toward a low-carbon economy is already underway, creating both risks and opportunities for investors. By understanding the climate-related challenges faced by different sectors and identifying investment areas that stand to benefit from climate-focused initiatives, investors can build resilient portfolios that align with environmental goals.

Ultimately, climate change is more than a challenge—it’s a call to action for investors. By supporting industries and technologies that promote sustainability, investors not only protect their portfolios but also contribute to a greener, more sustainable future.