In today’s world, environmental concerns are more pressing than ever. The shift toward sustainability is not just a trend but a critical business imperative, with companies adopting Environmental, Social, and Governance (ESG) frameworks to align their operations with global sustainability goals. Among the most impactful ways businesses can contribute to environmental sustainability is through the integration of renewable energy into their ESG strategies.

In this blog, we’ll explore the role of renewable energy in ESG, why it’s essential for reducing carbon emissions, and how companies can incorporate it into their long-term strategy to drive both environmental and financial success.

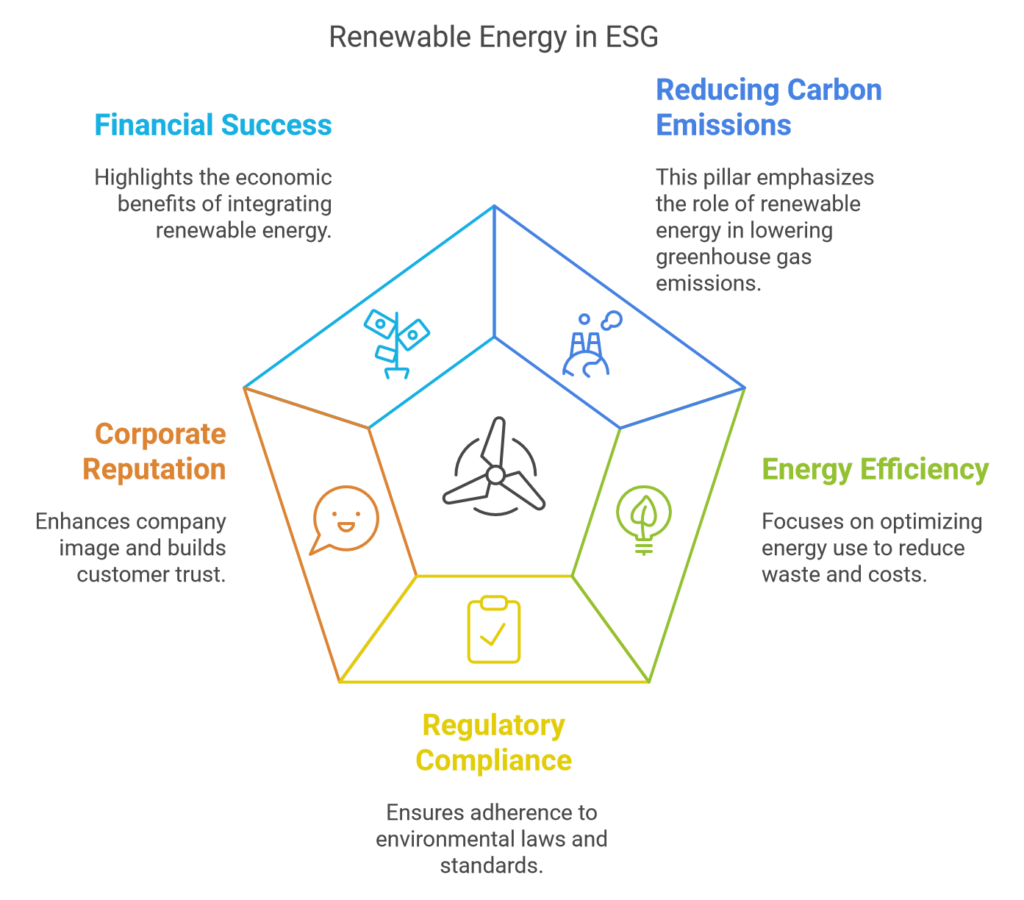

Why Renewable Energy is Crucial in ESG

The environmental component of ESG focuses on minimizing the negative impact businesses have on the planet. This includes reducing greenhouse gas emissions, improving resource efficiency, and mitigating the effects of climate change. Renewable energy plays a vital role in achieving these goals because it provides clean, sustainable alternatives to traditional fossil fuels.

Key benefits of renewable energy in an ESG strategy include:

1. Reducing Carbon Emissions

One of the primary drivers of climate change is the emission of carbon dioxide (CO2) from burning fossil fuels for energy. Renewable energy sources—such as solar, wind, hydropower, and geothermal—produce little to no greenhouse gas emissions, making them essential for companies looking to reduce their carbon footprint.

- Example: By transitioning to renewable energy, companies can drastically reduce their Scope 1 (direct emissions) and Scope 2 (indirect emissions from purchased electricity) emissions.

2. Improving Energy Efficiency and Cost Savings

While the initial investment in renewable energy infrastructure can be significant, the long-term benefits often outweigh the costs. Renewable energy can lead to substantial cost savings over time, especially as the cost of solar panels and wind turbines continues to fall. Many companies are finding that investing in renewable energy not only helps the planet but also improves their bottom line through reduced energy costs.

- Example: Companies like Apple and Google have committed to powering their operations entirely with renewable energy, reducing operational costs and enhancing brand reputation.

3. Meeting Regulatory and Investor Expectations

Governments and regulatory bodies are increasingly imposing stricter regulations on carbon emissions and energy use. By adopting renewable energy, companies can stay ahead of these regulatory requirements and avoid potential fines or penalties. Additionally, investors are placing more emphasis on ESG factors when making investment decisions. Companies with strong renewable energy commitments are often seen as lower risk and more future-proof by investors.

- Example: In India, the government has set ambitious renewable energy targets, pushing companies to integrate sustainable practices into their operations.

4. Enhancing Corporate Reputation and Customer Loyalty

As public awareness of environmental issues grows, consumers are increasingly choosing to support companies that demonstrate a commitment to sustainability. By incorporating renewable energy into their ESG strategy, businesses can enhance their corporate reputation, attract environmentally conscious customers, and build long-term brand loyalty.

- Example: Tesla, a leader in the renewable energy space, has built a reputation for innovation and sustainability, attracting both investors and customers who prioritize environmental responsibility.

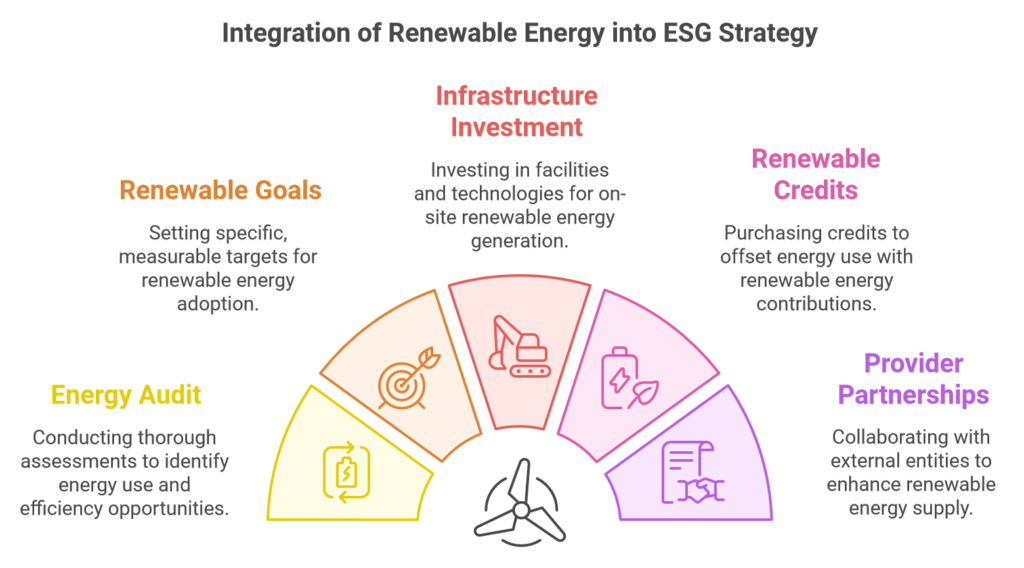

How Companies Can Integrate Renewable Energy into Their ESG Strategy

Incorporating renewable energy into an ESG strategy requires careful planning, investment, and long-term commitment. Below are key steps companies can take to integrate renewable energy into their operations effectively:

1. Conduct an Energy Audit

The first step toward integrating renewable energy is understanding your current energy usage. An energy audit helps businesses identify areas where they can reduce energy consumption and transition to cleaner energy sources. By analyzing energy data, companies can develop a roadmap for adopting renewable energy and setting achievable goals.

- Example: A manufacturing company might conduct an energy audit to identify opportunities to install solar panels or improve energy efficiency in their production process.

2. Set Clear Renewable Energy Goals

Setting measurable and achievable renewable energy goals is essential for a successful ESG strategy. These goals could include transitioning a certain percentage of your energy usage to renewable sources, achieving net-zero emissions by a specific date, or investing in off-site renewable energy projects.

- Example: IKEA has set a target to produce more renewable energy than it consumes by 2030, aligning with its broader sustainability goals.

3. Invest in On-Site Renewable Energy Infrastructure

One of the most effective ways to reduce reliance on fossil fuels is by generating renewable energy on-site. Companies can invest in installing solar panels, wind turbines, or geothermal systems at their facilities to produce clean energy for their operations. While the upfront investment can be significant, the long-term benefits in terms of reduced energy costs and carbon emissions are substantial.

- Example: Walmart has installed solar panels on the rooftops of many of its stores, generating renewable energy to power its operations and reduce its carbon footprint.

4. Purchase Renewable Energy Credits (RECs)

If installing on-site renewable energy infrastructure isn’t feasible, companies can still support the renewable energy sector by purchasing Renewable Energy Credits (RECs). RECs represent the environmental benefits of renewable energy and can be used to offset a company’s non-renewable energy consumption. By purchasing RECs, businesses can contribute to the growth of the renewable energy market.

- Example: Microsoft purchases RECs to offset its energy consumption and achieve its goal of becoming carbon neutral.

5. Partner with Renewable Energy Providers

Companies that cannot generate renewable energy on-site can enter into power purchase agreements (PPAs) with renewable energy providers. PPAs allow businesses to purchase renewable energy directly from wind, solar, or other renewable energy projects, supporting the development of clean energy infrastructure.

- Example: Google has signed multiple PPAs to purchase renewable energy directly from wind farms, ensuring that its data centers are powered by clean energy.

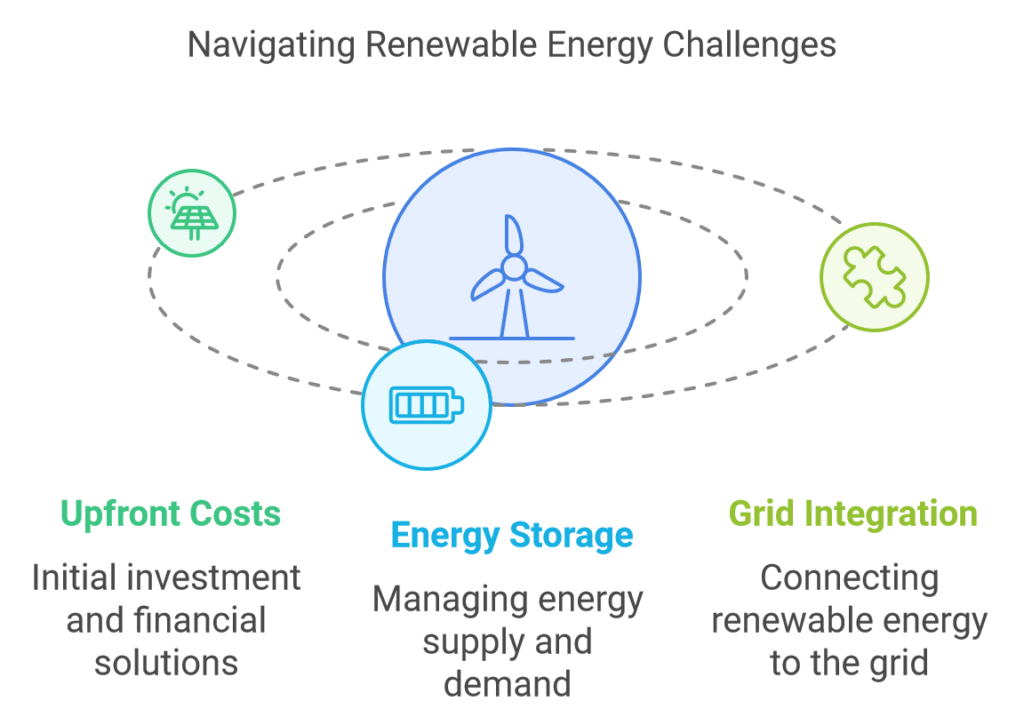

Overcoming Challenges in Adopting Renewable Energy

While the benefits of renewable energy are clear, there are several challenges that companies may face when incorporating renewable energy into their ESG strategy. Understanding these challenges and planning accordingly can help businesses navigate the transition more effectively.

1. Upfront Costs

One of the biggest barriers to adopting renewable energy is the initial investment required to install infrastructure such as solar panels or wind turbines. However, many governments offer tax incentives, grants, or subsidies to offset the cost of renewable energy projects. Additionally, companies can explore financing options, such as green bonds, to fund renewable energy investments.

2. Energy Storage

Renewable energy sources like solar and wind are intermittent, meaning they don’t produce energy consistently throughout the day. This can create challenges for businesses that require a reliable energy supply. Investing in energy storage solutions, such as batteries, can help companies store excess energy produced during peak times and use it when renewable energy generation is low.

3. Grid Integration

In some regions, integrating renewable energy into the local grid can be complex due to outdated infrastructure or regulatory barriers. Businesses can work with local governments and energy providers to address these challenges and explore options such as microgrids or distributed energy systems.

Conclusion

Renewable energy is a key pillar of any effective ESG strategy, offering companies the opportunity to reduce their carbon footprint, cut energy costs, and improve their overall sustainability. By conducting energy audits, setting clear renewable energy goals, investing in on-site infrastructure, and partnering with renewable energy providers, businesses can align their operations with the global shift toward clean energy.

As the world continues to prioritize sustainability, businesses that incorporate renewable energy into their ESG strategy will not only help mitigate climate change but also gain a competitive edge by appealing to eco-conscious investors, customers, and employees. Embracing renewable energy is not just an ethical choice—it’s a smart business decision that can drive long-term value and resilience in an increasingly sustainability-focused marketplace.